Illinois Army veteran spared foreclosure after tax mix-up resolved in Chicago suburb

Army veteran spared foreclosure after tax mix-up resolved in Chicago suburb

A Cook County veteran nearly lost his home over a tax error, but 24 hours later, everything changed.

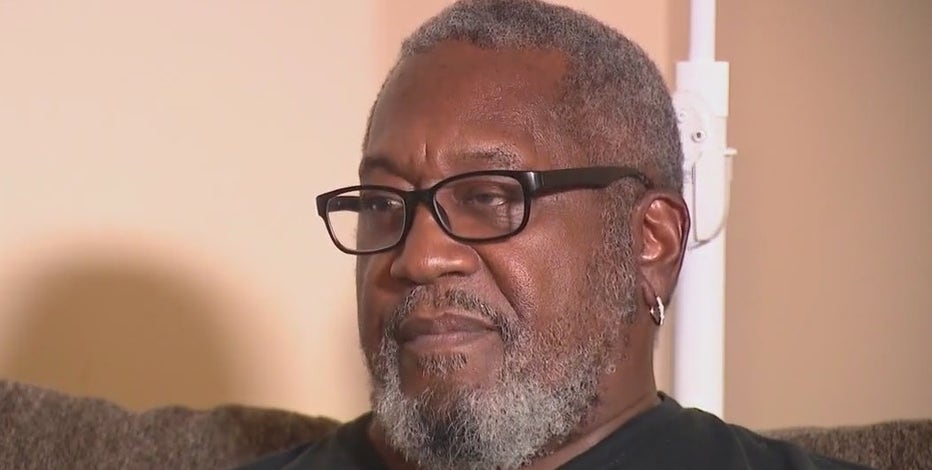

COOK COUNTY - In a dramatic turnaround in less than 24 hours, Army veteran Martin Guest is no longer facing the threat of foreclosure and has had the disputed tax bill on his suburban Glenwood home cleared.

Guest, who is rated 100 % disabled, was facing a property tax bill that state law says he should not have owed.

The backstory:

Guest, a U.S. Army veteran who served 21 years and now raises a 15-year-old son, had purchased his home in summer 2023.

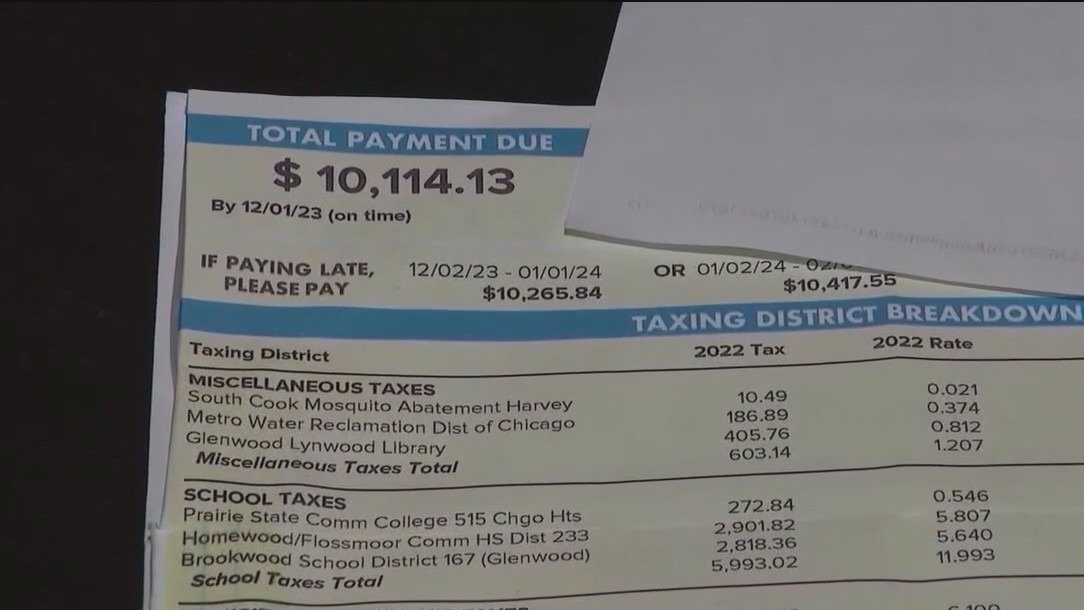

Shortly after moving in, he received a bill for more than $10,000 in property taxes despite being eligible for the full "Veterans with Disabilities Exemption" under Illinois law.

The Cook County Assessor’s Office later issued a certificate of error that reduced his tax bill to zero.

Guest approached his lender, U.S. Bank, to adjust his mortgage so it would reflect his tax-exempt status. The bank confirmed it investigated and is working with Guest and Cook County to correct the "county’s error."

Featured

Paperwork error puts Chicago-area veteran’s home at risk

A paperwork mistake and a tug-of-war between Cook County and his bank now threaten to take away the home one veteran fought so hard to earn.

Guest says he can now focus on raising his son and looking after his emotional support dog without the constant fear of losing his home.

Dig deeper:

Under Cook County’s rules, veterans with service-connected disabilities certified by the U.S. Department of Veterans Affairs may receive a full reduction in the equalized assessed value (EAV) of their primary residence if their disability rating is 70% or greater, which can result in zero property tax liability.

In Guest’s case, however, the prior owner of the home had not applied for the veteran’s disability exemption for the period January–July 2023, triggering a tax bill of roughly $6,800. The Assessor’s Office says it is waiting on a system upgrade to finalize the remaining refund for the year.

What's next:

Guest is scheduled to meet with U.S. Bank on November 19 to ensure his mortgage is adjusted to reflect the zero tax status.

While the immediate tax threat appears resolved, the backlog of paperwork and pending refunds from Cook County mean the timeline for full resolution remains uncertain. Guest’s home had already entered foreclosure proceedings before the issue was corrected.

Guest says that with the tax confusion resolved, he finally can breathe.

"I can now relax knowing that I can raise my son and keep my dog Cici by my side," he said.

The Source: FOX 32's Tia Ewing reported on this story.