Personal loans may help you pay off $10K worth of credit card debt 10 years faster: Here's how

Consolidating your credit card debt into a personal loan at a lower rate can help you get out of debt years faster and save extra money on interest charges. (iStock)

Credit cards may give savvy consumers a way to earn rewards on their everyday spending, but they can also create a cycle of high-interest debt that's difficult for borrowers to repay. Calculations show it can take more than a decade to pay off high-interest credit card debt if you're just making the minimum monthly payment, especially if you keep adding to the balance before it's fully paid off.

Of concern, Americans have been adding to their credit card balances at record rates in recent months, according to the Federal Reserve Bank of New York. With rising levels of credit card debt, some consumers may be looking for ways to repay their balances and break the cycle of high-interest debt.

One way to pay off credit card debt faster is to consolidate your debt into a fixed-rate personal loan. Credit card consolidation loans come with predictable monthly payments over a set period of time, typically just a few years.

Keep reading to learn more about how using a personal loan can help you pay off credit card debt faster. You can also visit Credible to compare personal loan interest rates for free without impacting your credit score.

PROS AND CONS OF BALANCE TRANSFER CREDIT CARDS

A personal loan can help you pay off credit card debt faster

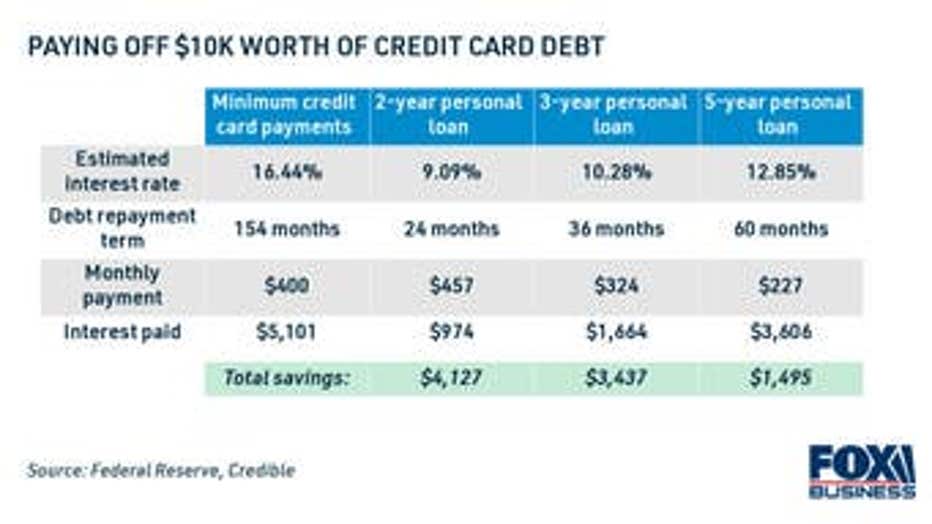

With the average credit card interest rate at 16.44%, according to the Federal Reserve, it can take 12 years and 10 months of minimum payments to repay a balance of $10,000 — and that's only if you cut credit card spending altogether while you repay the debt. Credit card minimum payments are either a small, fixed amount or a percentage of the total amount you owe, typically between 2% and 4%, according to Experian.

Consolidating your credit card debt into a two-year personal loan could help you pay off your balances more than 10 years faster, all while saving you more than $4,000 in total interest charges. That's because the average personal loan rate for this term is a record-low 9.09%, the Fed reports.

15 BEST DEBT CONSOLIDATION LOANS FOR FAIR CREDIT

Personal loan rates are also near all-time lows for longer terms, Credible data shows. Well-qualified applicants who borrowed a personal loan during the week of Feb. 17 saw average rates of 10.28% for the three-year term and 12.85% for the five-year term.

By refinancing to a five-year personal loan, you could pay off your debt nearly 8 years faster and save about $173 on your monthly payments. If you consolidate into a three-year personal loan, you can pay off your credit card balances 9 years and 10 months faster, all while lowering your monthly debt payments and saving thousands in interest charges over time.

You can use Credible's personal loan calculator to estimate your monthly payments and potential savings using this debt payment strategy.

WHAT IS THE LIMIT ON A BALANCE TRANSFER CARD?

How to consolidate credit card debt while rates are low

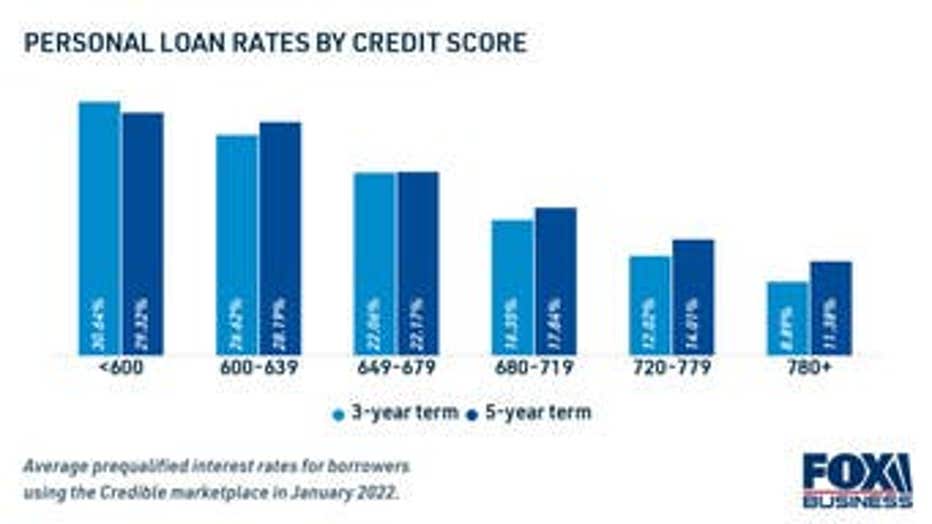

Borrowers can save more money than ever before on credit card consolidation as personal loan rates are historically low. But just because average interest rates are low doesn't mean all applicants will get a good rate.

Personal loans are typically unsecured, which means they don't require collateral that the lender can seize if you don't repay the loan. As a result, personal loan lenders determine a borrower's interest rate and eligibility based on their previous credit history, including credit score and debt-to-income ratio (DTI).

DEBT SNOWBALL METHOD VS. DEBT AVALANCHE METHOD

Here's what the personal loan application process looks like — and how to get a low interest rate:

- Determine the total amount you need to borrow by adding up all the credit card balances you want to consolidate into a loan.

- Work on getting a good credit score to improve your chances of getting a low interest rate. You can enroll in free credit monitoring services on Credible.

- Get prequalified with a soft credit inquiry to compare interest rates with multiple lenders. This will not impact your credit score.

- Choose the best loan offer. Read the loan agreement to get a better idea of the repayment plan, including the interest rate, origination fee and any prepayment penalties.

- Formally apply for the loan, which will require a hard credit inquiry. Upon loan approval, the funds may be deposited directly into your bank account as soon as the next business day.

BANKRUPTCY FILINGS CONTINUE TO DECLINE DESPITE SKYROCKETING CREDIT BALANCES

If you're approved for the personal loan, you can use the funds to pay off your credit card balances to zero. Just be careful to avoid overspending going forward, so you don't rack up new credit card debt while you're repaying the personal loan.

You can browse current personal loan rates in the table below, and visit Credible to shop around with multiple lenders at once. This can help you find the lowest interest rate possible for your financial situation.

3 RISKS OF RELYING ON CREDIT CARD BALANCE TRANSFERS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.