Having a college degree can double your earning potential, but only if you do this

A college degree can pay off in the form of higher earning potential, but the total cost of attendance causes many students to take out debt. See a few ways to borrow undergraduate student loans without eating into your income. (iStock)

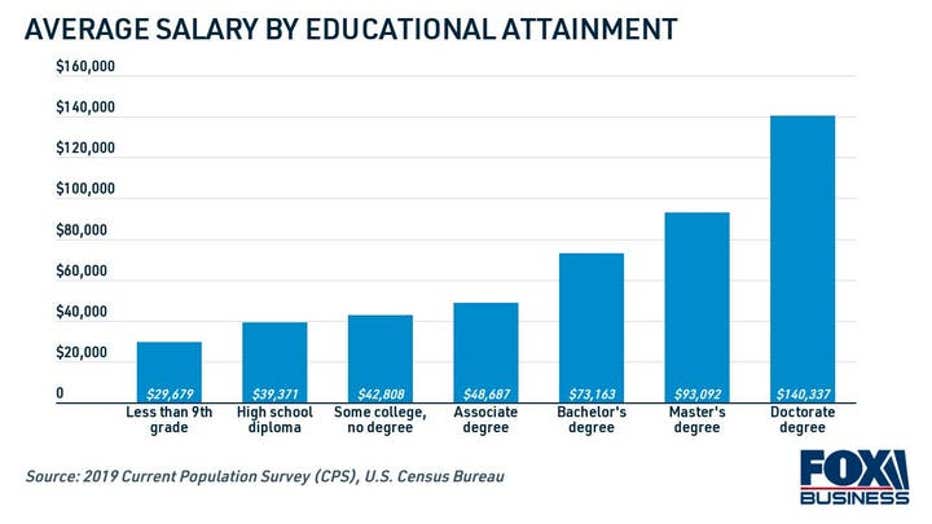

As college costs continue to rise and student loan debt skyrockets, Americans may wonder if getting a degree is truly worth the money. The most recent data from the U.S. Census Bureau confirms that a college education may still be a worthwhile investment, with degree recipients earning nearly twice as much money as those without a college diploma.

High school graduates make about $39,000 per year, while those with a Bachelor's degree earn $73,000. The potential for higher earnings increases with post-secondary education, with Master's degree graduates earning $93,000 and doctorate recipients pulling in well over six figures at $140,000.

This data suggests that getting a college degree pays off in the form of higher earning potential, but it's important to consider the investment that today's students must make in order to attain a healthy wage. The majority of college students must borrow student loans in order to finance the cost of college, and college debt can spiral out of control if borrowers aren't cautious.

There are a few steps students and graduates should take when planning on how to pay for their education:

- Research student loan forgiveness and work-study programs

- Borrow student loans strategically while you're in school

- Refinance your college debt after graduating

Keep reading to learn more about financing a college education so that you can reap the financial rewards of a college diploma without being trapped in a cycle of student loan debt. If you're considering borrowing private student loans to help pay for college, visit Credible to see offers from multiple lenders without impacting your credit score.

3 TIPS TO HELP EASE THE BURDEN OF STUDENT LOANS ONCE DEFERMENT ENDS

Research student loan forgiveness and work-study programs

Student loan forgiveness became a primary focus of President Joe Biden's campaign during the 2020 election cycle, but the widespread cancellation of student loan debt has been a difficult promise to keep.

College students shouldn't take out more student loan debt than they can handle in the hopes that it will eventually be forgiven, but there are a few federal student loan forgiveness programs that may help reduce the cost of a college education:

- Public Service Loan Forgiveness (PSLF): Public servants like government employees, public school teachers and nonprofit workers may have the remaining balance of their federal student loans discharged after making 120 consecutive payments. However, qualification can be tricky: 98% of PSLF applications were rejected, according to the most recent data.

- Teacher Loan Forgiveness (TLF): Full-time teachers who work for five consecutive years in a low-income school may be eligible for up to $17,500 in federal student loan cancellation.

- Borrower Defense to Repayment: If your school engaged in misconduct or violated state laws, you may be eligible to have your federal Direct loans discharged under the borrower defense program. The Biden administration has forgiven $1.5 billion worth of student loan debt under borrower defense.

Depending on your course of study, your school may offer work-study programs that can help finance the cost of your education. For example, medical school students may be able to find work in a research lab to have tuition paid for while earning income — and even receiving healthcare benefits.

HOW TO CHECK YOUR CREDIT SCORE FOR FREE WITHOUT PENALTY

Borrow student loans strategically while you're in school

When borrowing money to pay for college, federal student loans are a good place to start. These loans are backed by the Department of Education (DOE) and come with federal protections like economic hardship forbearance and income-driven repayment (IDR) plans. Plus, federal student loans may be eligible for student loan forgiveness programs like PSLF and TLF.

Fill out the Free Application for Federal Student Aid (FAFSA) to see what kind of financial aid and federal loans you're eligible for. Direct Subsidized loans, for example, are based on financial need. The DOE pays the interest while you're in school and for the first six months after graduating, making this a good option for borrowers to reduce the cost of borrowing.

Then consider other federal student loans, like Direct Unsubsidized loans. These are available to all college students regardless of need and come with a low, fixed interest rate. The interest rate on Direct Loans is 3.73% for undergraduate students and 5.28% for graduate and professional students for loans disbursed before July 2022.

However, Direct loans come with borrowing limits that may not sufficiently cover the cost of attendance. A dependent undergraduate student can borrow a maximum of $31,000 in federal Direct loans for their entire college tenure. Graduate students can borrow a maximum of $20,500 in Direct loans per year.

STUDENT LOAN ELIGIBILITY REQUIREMENTS FOR ONLINE SCHOOL

Federal student loan limits may make it necessary for you to bridge the gap with PLUS loans or private student loans. Direct PLUS loans come with the highest interest rates of all federal loans and are only available to graduate students or parents of undergraduate students. PLUS loans have a fixed interest rate of 6.28%, plus a one-time fee of 4.228%.

Private student loans, on the other hand, are issued by private lenders. They don't come with the same borrower protections as federal student loans, but they may come with a much lower interest rate, depending on the borrower's creditworthiness and the repayment term.

Borrowers with a good credit history who took out 10-year fixed-rate private student loans using the Credible marketplace saw an average interest rate of 5.38% during the week of Aug. 9. Rates on 5-year variable-rate loans were even lower, at 3.04%. Interest rates may be even lower if a borrower enlists the help of a creditworthy cosigner.

Browse fixed rates and variable interest rates from real private student loan lenders in the table below. Visit Credible to see your estimated interest rate without impacting your credit score before formally applying for a loan.

4 CREDIT UNIONS TO CONSIDER WHEN REFINANCING STUDENT LOANS

Refinance your college debt after graduating

Student loan refinancing can help borrowers pay off their debt faster, lower their monthly payments and even save money on interest over time. Plus, student loan refinancing companies are prohibited from charging prepayment fees, which means that you can refinance your private loans without worrying about added financing costs.

Private student loan interest rates are near historic lows, which means it may be a good time to refinance to save money on your student loan payments or expedite your college debt repayment plan. Plus, private student loans tend to come with more flexible repayment options than federal loans.

One caveat: It's not recommended that borrowers refinance their federal student loans right now, since refinancing to a private loan would make them ineligible for federal protections like COVID-19 forbearance, IDR plans and even student loan forgiveness programs like PSLF. However, refinancing your private student loan debt can pay off.

Borrowers who refinanced to a shorter loan term on Credible saved nearly $17,000 on interest charges, and borrowers who refinanced to a longer repayment plan were able to lower their monthly payments by $250 per month. See how much you can save on your student loan debt with Credible's student loan refinance calculator.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.