UFC, WWE join to create $21.4B sports entertainment company

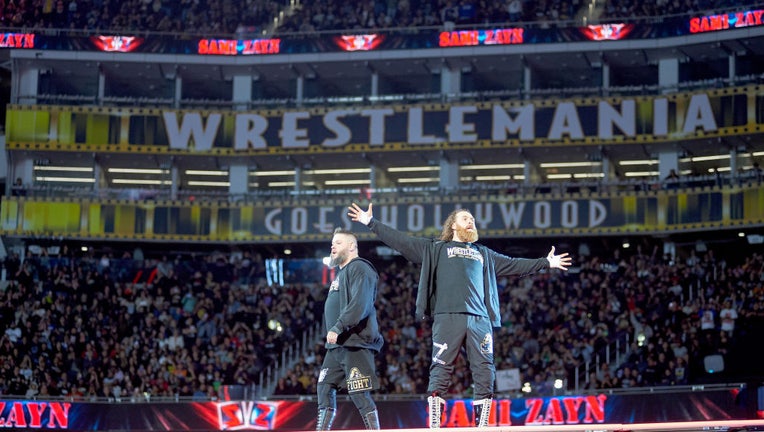

Kevin Owens and Sami Zayn wrestle The Usos for the Undisputed WWE tag team championship during WrestleMania 39 at SoFi Stadium on April 01, 2023 in Inglewood, California. (Unique Nicole/Getty Images)

WWE and the company that runs Ultimate Fighting Championship will combine to create a $21.4 billion sports entertainment company.

A new publicly traded company will house UFC and World Wrestling Entertainment brands, with Endeavor Group Holdings Inc. taking a 51% controlling interest in the new company. Existing WWE shareholders will hold a 49% stake.

The companies put the enterprise value of UFC at $12.1 billion and WWE's value at $9.3 billion.

RELATED: Snoop Dogg steps in at last second during WrestleMania 39

The new business, which does not yet have a name, will be lead by Endeavor CEO Ari Emanuel. Vince McMahon, executive chairman at WWE, will serve in the same role at the new company. Dana White will continue as president of UFC and Nick Khan will be president at WWE.

"Together, we will be a $21+ billion live sports and entertainment powerhouse with a collective fanbase of more than a billion people and an exciting growth opportunity," McMahon said in a prepared statement Monday.

(R-L) Cory Sandhagen reacts after his victory over Marlon Vera of Ecuador in a bantamweight fight during the UFC Fight Night event at AT&T Center on March 25, 2023 in San Antonio, Texas. (Josh Hedges/Zuffa LLC via Getty Images)

He also provided some idea of where the focus of the new company will be, saying that it will look to maximize the value of combined media rights, enhance sponsorship monetization, develop new forms of content and pursue other strategic mergers and acquisitions to further bolster their brands.

RELATED: Vince McMahon returns to WWE board, eyes sale of company

A synergy already exists talent wise between WWE and UFC, with stars such as Brock Lesnar and Ronda Rousey crossing over between the two businesses.

The deal between Endeavor and WWE catapults WWE into a new era, after functioning as a family-run business for decades. McMahon purchased Capitol Wrestling from his father in 1982, and took the regional wrestling business to a national audience with the likes of wrestling stars such as Andre the Giant, Hulk Hogan and Dwayne "The Rock" Johnson.

The company, which changed its name to World Wrestling Federation and later World Wrestling Entertainment, hosted its first WrestleMania in 1985.

The announcement of the WWE transaction arrives after McMahon, the founder and majority shareholder of WWE, returned to the company in January and said that it could be up for sale.

RELATED: Stephanie McMahon resigns as WWE co-CEO

Rumors swirled about who would possibly be interested in buying WWE, with Endeavor, Disney, Fox, Comcast, Amazon and Saudi Arabia's Public Investment Fund all in the mix.

Media industry analysts viewed WWE as an attractive target given its global reach and loyal fanbase, which includes everyone from minors to seniors and a wide range of incomes.

The company held its marquee event, WrestleMania, over the weekend. Last year, WWE booked revenue of $1.3 billion.

The company is also a social media powerhouse. It surpassed 16 billion social video views in the final quarter of last year. It has nearly 94 million YouTube subscribers and has more than 20 million followers on TikTok. Its female wrestlers comprise five out of the top 15 most followed female athletes in the world, across Facebook, Twitter & Instagram, led by Ronda Rousey with 36.1 million followers.

WWE had more than 7.5 billion digital and social media views in January and February of this year, up 15% from the same time frame a year ago.

The new company plans to trade on the New York Stock Exchange under the "TKO" ticker symbol. Its board will have 11 members, with six being appointed by Endeavor and five being appointed by WWE.

"We like the assets of UFC and also WWE in a world where linear TV is losing market share to streaming, thus live sport content is in high demand," wrote Jeffries analyst Randal Konik said in a note to clients.

The transaction, which was approved by the boards of Endeavor and WWE, is targeted to close in the second half of the year. It still needs regulatory approval.

Shares of World Wrestling Entertainment Inc., based in Stamford, Connecticut, are up 33% this year, but fell more than 6% before the opening bell on Monday. Shares of Endeavor, based in Beverly Hills, California, rose more than 4%.